What is an ESOP?

What is an ESOP?

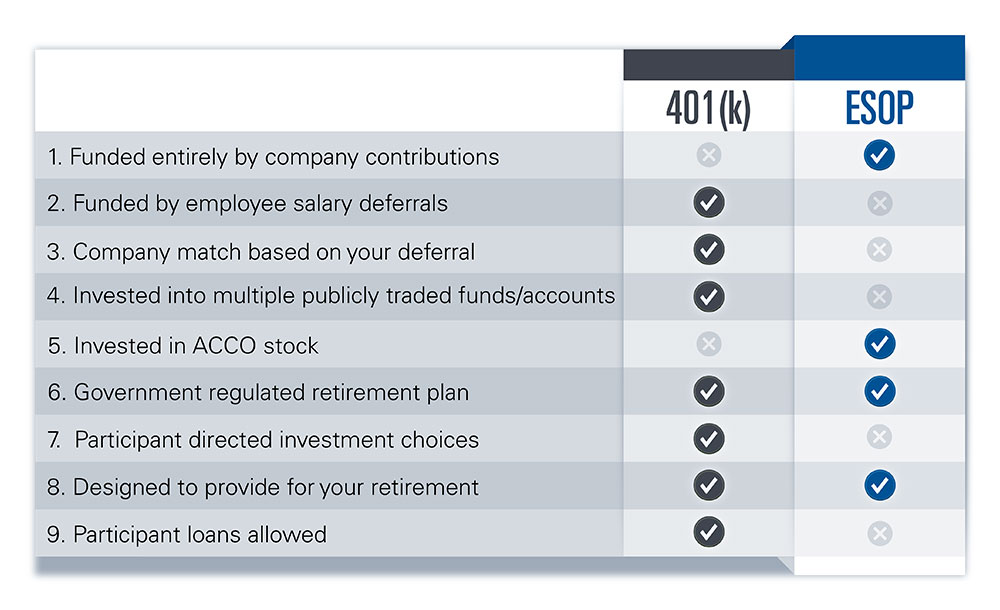

An Employee Stock Ownership Plan (ESOP) is a tax-qualified employee benefit plan governed by U.S. law. An ESOP is a defined contribution retirement plan (like a Profit Sharing or 401(k) Plan) designed to hold company stock and provide eligible employees with benefits when they retire or leave the company.

ACCO’s ESOP is a free benefit available to all non-signatory employees of the company and its’ subsidiaries that meet the eligibility requirements.

As an ACCO ESOP participant, you have a unique chance to contribute to the growth of the company AND influence the value of your retirement savings.

What is an ESOP?

What is an ESOP?